Altman Z-Score Infinite

Insights beyond the traditional Z-Score!

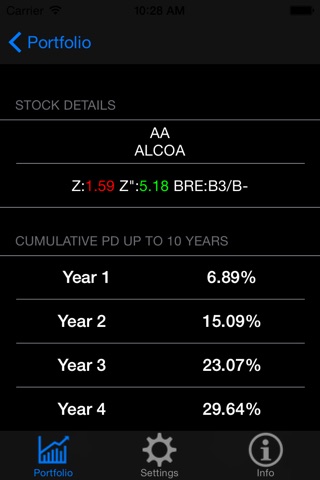

1. Estimate Bond Rating Equivalent (BRE)

2. Rank firms within and across industry

3. Predict 1-10 years of Probability of Default (PD)

3.1. Existing bond/loan

3.2. New Bond/loan

This App has been developed and enhanced in collaboration with Dr. Edward I. Altman, Max L. Heine Professor of Finance at the Stern School of Business, New York University to deliver following 4 benefits:

1. Make informed corporate lending decisions

2. Manage accounts receivable more effectively

3. Select corporate equity and debt securities

4. Identify and manage corporate defaults and turnarounds

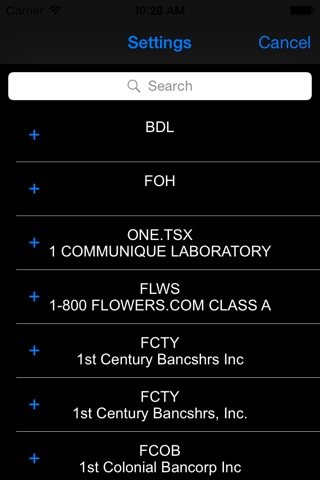

Analyze any of 7000+ publicly traded industrial companies trading in US Exchanges (NYSE, NASDAQ, AMEX, OTC BB & Pinksheet) and Canada listed companies by entering ticker symbol.

Scan for companies based on filter criteria.

Key Features:

1. Analyze Z, Z and Z" scores for Public US Manufacturing, Private US Manufacturing, US Public & Private Non-Manufacturing and Public/Private Foreign industrial firms

2. Generate Bond Rating Equivalent (BRE)

a. Based on industry category

b. Credit Rating Agency latter and alphanumeric grades

3. Generate probability of default (PD) over 1-10 years of time horizon into future for existing loans/bonds and/or all customers as well as for new bond/loan issues

Functionalities:

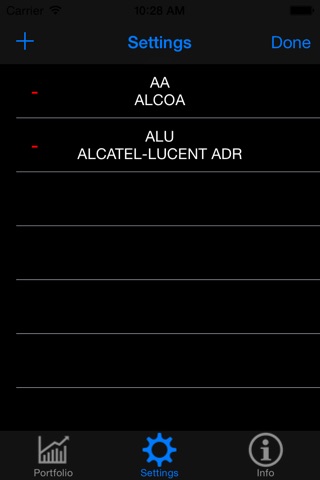

1. Search on companies and add to portfolio. Delete companies from portfolio.

2. Check Z-Series Scores, Bond Rating and 1-10 years of Probability of Default on screen

Refresh Frequency:

1. Benchmarks and Percentiles will be updated at least once a year.

2. Company data will be refreshed on a quarterly basis